Tired of spreadsheets, missed deadlines, and the constant worry that something’s off in your books? You know it’s time to make a change, but the idea of hiring a bookkeeper feels like a big leap. Is it even worth it?

How much does it cost to hire a bookkeeper anyway? This CEO Guide to how much it costs to hire a bookkeeper will answer all your questions and provide a roadmap for how to go about finding the best bookkeeper match for your business.

What Do Bookkeepers Do for Small Businesses?

Bookkeepers handle the day-to-day management of your financial transactions. They keep your books balanced by tracking income and expenses, managing payroll, and accounting for every dollar.

They also maintain accurate financial records, prepare financial reports, and keep your business compliant with tax laws and regulations. Bookkeepers free you up to focus on growing your business without getting bogged down by financial details.

Factors Affecting Bookkeeper Costs

Bookkeeping isn’t a one-size-fits-all industry. You’ll save yourself time and money if you assess what makes your perfect bookkeeping match. Here are some factors that will impact your overall cost:

-

Business Size/Complexity

The larger and more complex your business, the more time and expertise your bookkeeper will need which can increase cost.

-

Scope of Services

Basic bookkeeping covers essential tasks, while full-service bookkeeping includes additional responsibilities like financial analysis and tax preparation.

-

Frequency of Services

The frequency at which you require bookkeeping services—weekly, monthly, or quarterly—will also affect the price.

-

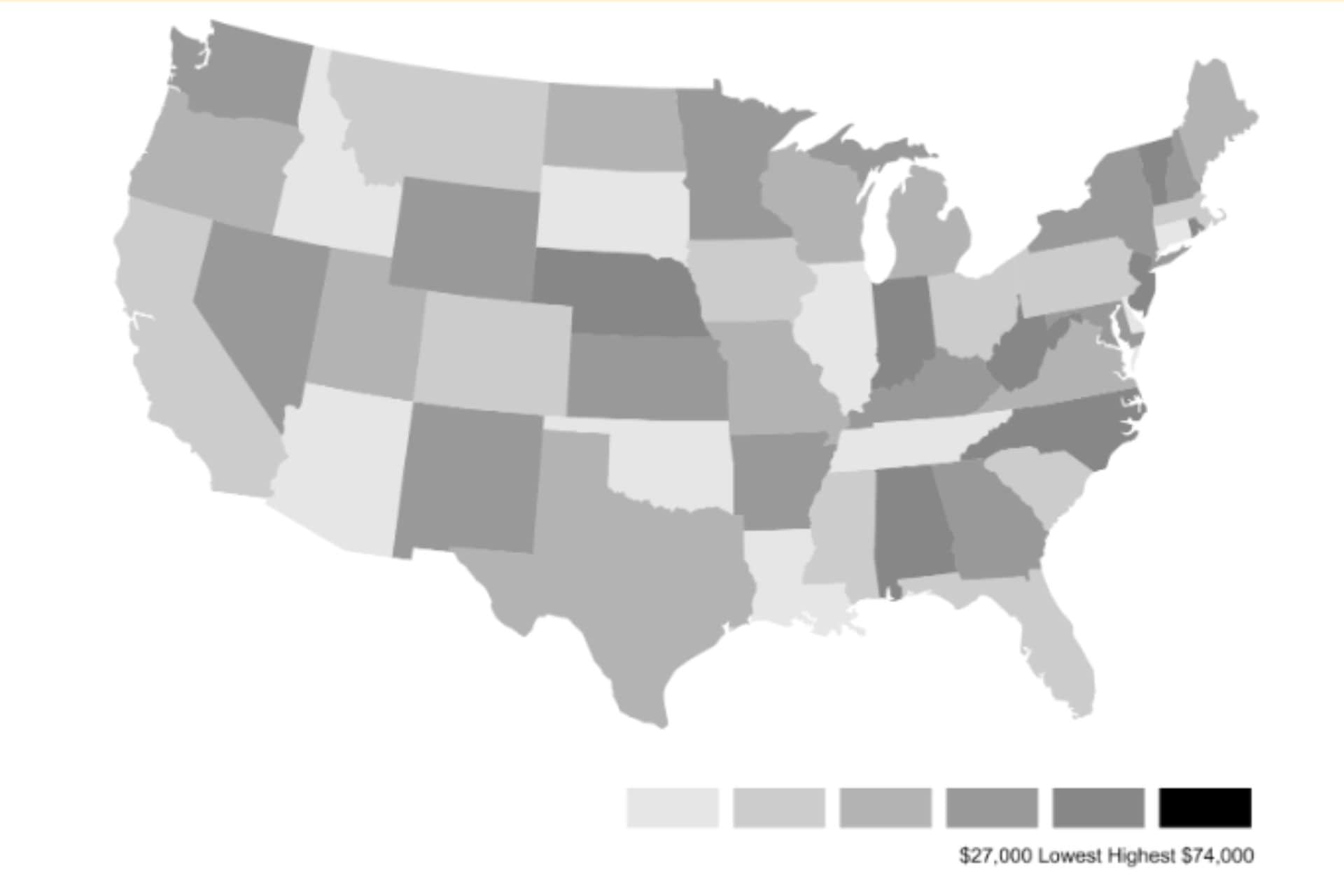

Location

The cost of bookkeeping services can vary based on your location—for example, urban areas typically have higher rates than rural ones.

-

Bookkeepers Experience

Experienced bookkeepers with specialized skills or certifications will generally charge more than those just starting.

-

Additional Services

Add-ons like tax preparation, payroll management, financial analysis, controller services, and software implementation can significantly increase your bookkeeping expenses. For example:

Tax preparation: Gathering documentation, filing taxes, and audit support can cost $200-$500 per month during tax season.

Payroll: Managing payroll and compliance may add $10-$25 per worker monthly.

Financial analysis: Offering insights into profitability, cash flow, and growth can increase your costs.

Controller services: Overseeing finance operations might range from $25 to $60 per hour.

Software implementation: Setting up and training on new accounting software could be a one-time fee of $300-$1,000+.

Types of Bookkeeping Fee Structures with Average Pricing

After assessing the scope of your business’s financial needs, it’s important to be familiar with pricing models in the industry. Here are a few common examples of how bookkeepers may charge for their services:

-

Hourly Rates

Charged per hour of work, common for small businesses. $30 to $100 per hour.

-

Monthly Packages

Fixed-rate for ongoing services, ideal for consistent needs. $300 to $1,500 per month.

-

Per Transaction

Charged per financial transaction process. $2 to $5 per transaction.

-

Project-Based

Flat fee for specific one-time projects or setups. $500 to several thousand dollars.

Outsourcing vs. In House Bookkeeping

Not only are there pricing models within the industry, but there are also different ways you can hire a bookkeeper—outsourcing and in-house bookkeeping.

Outsourcing bookkeeping involves hiring a third-party provider to manage your financial records. This option is flexible, with costs typically based on hourly rates ($30 to $100 per hour), monthly packages ($300 to $1,500 per month), or per transaction.

Outsourcing allows you to access specialized expertise and scale services as needed, but you might have less direct control over daily operations.

In-house bookkeeping means hiring a dedicated employee within your business to handle bookkeeping tasks. This provides more control to financial management, with costs usually in the form of a salary, ranging from $20 to $60 per hour or $3,500 to $5,000+ per month.

While in-house bookkeepers offer personalized service and are always available, this option involves higher overhead costs, including benefits, office space, and training.

Tips for Hiring a Stellar Bookkeeper

Hiring a bookkeeper isn’t a simple choice. It’s important to find the best match for your business. Here are some tried and true tips to help you narrow down your candidate pool:

-

Check credentials and experience.

Look for certifications like Certified Public Bookkeeper (CPB) or experience in your industry. A strong background ensures they can handle your specific financial needs.

During interviews, inquire about their experience with your industry, preferred accounting software, and how they handle common challenges like ledger errors or tax deadlines.

-

Look for strong communication skills.

A great bookkeeper should be able to explain financial concepts clearly and keep you informed about your business’s financial status.

-

Assess their attention to detail.

Bookkeeping requires meticulous attention to detail. Ask them how they ensure accuracy in their work and manage complex financial records.

-

Test their problem-solving abilities.

Financial challenges are inevitable. Ask how they approach unexpected issues and ensure they have a proactive mindset to catch potential problems before they escalate.

-

Check the culture fit.

Your bookkeeper will be a key part of your team. Make sure they understand your business’s values and can work well with your existing team.

Mistakes to Avoid When Hiring a Small Business Bookkeeper

There are common pitfalls that many business owners fall into during the hiring process. Here are the key missteps to watch out for when hiring a small business bookkeeper.

Prioritize cost over quality.

While it’s tempting to go for the cheapest option, hiring a bookkeeper based solely on price can lead to costly mistakes. Look for experience and expertise.

Not checking references and reviews.

Skipping background checks or failing to contact references can leave you vulnerable to hiring someone unqualified or unreliable.

Overlook industry experience.

A bookkeeper with no experience in your specific industry may struggle to manage your finances effectively.

Failure to clarify expectations and deliverables.

Without clear communication about roles and responsibilities, you risk misunderstandings that could impact your financial health.

Ignore red flags during interviews.

If something feels off during the interview process—whether it’s a lack of professionalism or vague answers—trust your instincts and keep looking.

FAQ’s

How much should you pay someone to do your bookkeeping?

You should expect to pay between $150 for solopreneurs and $2500 for large companies. Most bookkeepers land between $250-$450/mo depending on the bookkeeper’s experience, location, and the complexity of your business’s financial needs.

Is it worth getting a bookkeeper?

Yes, hiring a bookkeeper is worth it for most businesses. They save you time, reduce errors, and ensure your financial records are accurate, allowing you to focus on growing your business.

Is a bookkeeper cheaper than an accountant?

Yes, bookkeepers are generally cheaper than accountants. While bookkeepers handle daily financial tasks, accountants focus on more complex financial analysis and tax preparation, which often comes at a higher cost.

How much do people charge to do QuickBooks bookkeeping for small businesses?

QuickBooks bookkeeping services typically range from $30 to $80 per hour, depending on the bookkeeper’s experience and the complexity of the tasks required.

It’s Time to Fire Yourself: Let the Right Bookkeeper Find You!

It’s time to step away from the spreadsheets and get back to your business. Bookkeeping MatchUp is ready to help you find your perfect bookkeeping match.

Book a free consultation and get your business in the best hands!