You’re running your business, money’s moving, and receipts are flying—but if I asked you to show your bookkeeping records, would you know where to start?

If the answer is “uh…”—don’t worry. Keeping clean, clear records doesn’t have to be complicated. In fact, once you see a few example bookkeeping records, it all clicks.

Let’s walk through the kinds of records every small business should be keeping—and how to stay organized without getting buried in your own spreadsheets.

What are Bookkeeping Records?

Bookkeeping records are the documents that track your business’s financial activity. They show accounts payable, accounts receivable, and what’s left over, giving you an overview of your financial position.

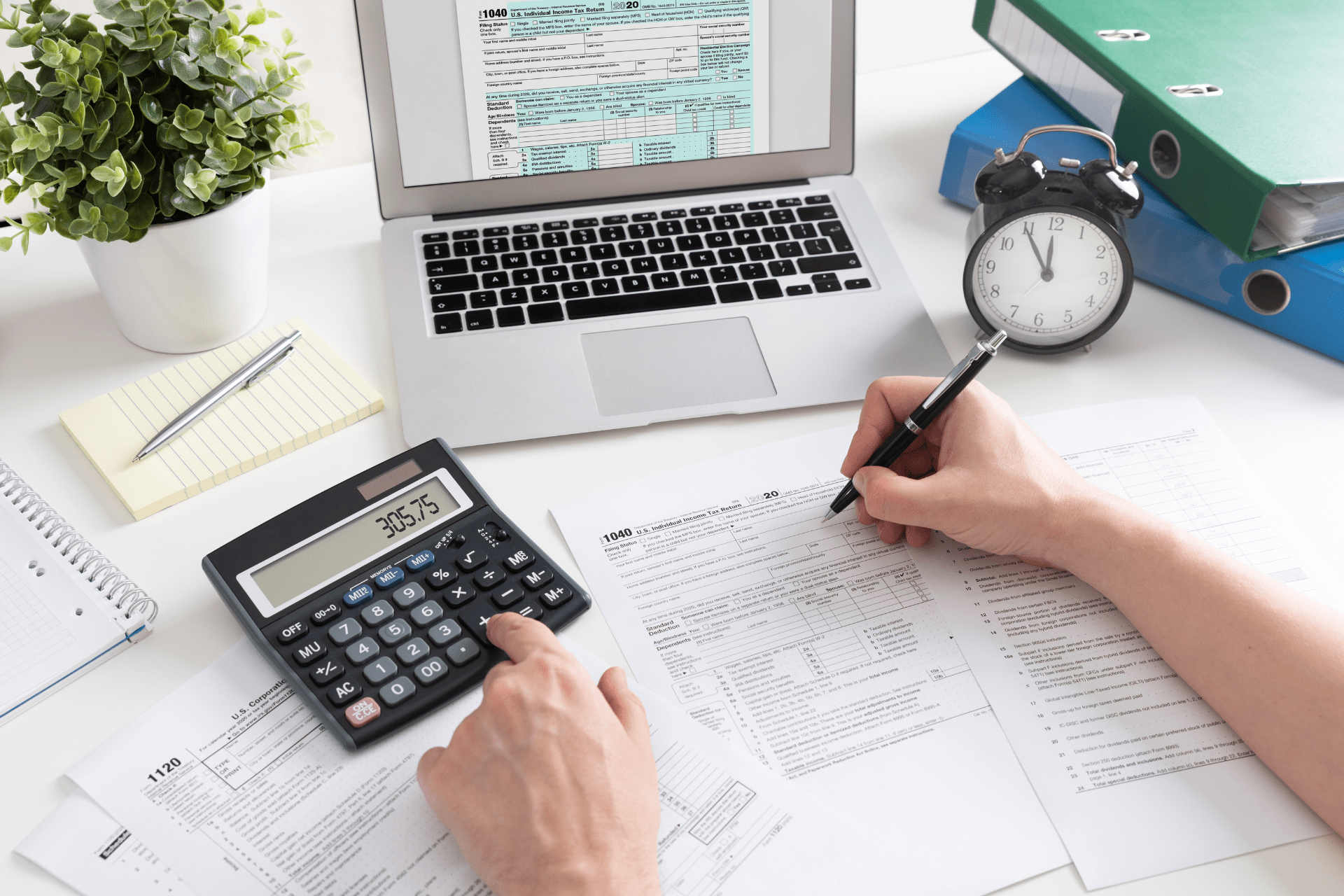

If money moves, there should be a record of it. That includes invoices, cash receipts, payroll reports, bank statements, and every little thing in between.

This information keeps transactions from falling through the cracks, so you know where the money is flowing through your business at all times. Financial reports on this information are how you prove what happened when tax time rolls around or if an auditor ever comes knocking.

The cleaner and more complete these records are, the easier everything else becomes.

Main Types of Bookkeeping for Small Businesses

Before you start tracking every dollar, you need to know how you’re tracking it. There are two main methods of bookkeeping that small businesses use, and the one you choose depends on how complex your finances are.

-

Single-entry bookkeeping

This is the simplest method. You record each financial transaction once—either as income or an expense. It works well for very small businesses, freelancers, or anyone with a straightforward income and spending. It’s like balancing a cash book or checkbook.

Single-entry doesn’t track assets and liabilities, so it gives you a limited view of your business’s financial health.

-

Double-entry bookkeeping system

This method records each transaction twice: once as a debit and once as a credit. It’s a little more work up front, but it keeps your books balanced and gives a much clearer picture of your finances.

If your business is growing, has inventory, or you’re dealing with vendors and payroll, double-entry bookkeeping is the way to go. Most accounting software (including QuickBooks) is built around this system.

Why You Need Bookkeeping Records

Bookkeeping records are proof that your business exists, operates, and earns money. Without the data they provide, you’re guessing at profits, scrambling during tax season, and crossing your fingers during an audit.

They help business owners see patterns, spot problems early, and plan for growth. Want to apply for a loan? You’ll need records. Want to hire? Same thing. Want to sleep better knowing your finances aren’t a mess? That starts with solid bookkeeping.

Clean, consistent records mean fewer surprises and smarter decisions. They’re essential to running a real, legit business.

11 Example Bookkeeping Records You Should Be Tracking

Now that you know the basics, let’s get into what real bookkeeping records actually look like. These are the documents and data points that should live in your bookkeeping system—whether you’re using Excel, bookkeeping software, or working with a pro bookkeeper.

-

Accounts Payable

Accounts payable records show what you owe—bills from vendors, suppliers, or service providers. It keeps track of due dates, amounts, and what’s already been paid.

-

Accounts Receivable

This is the money that clients or customers owe you. Think unpaid invoices. This record helps you follow up, stay on top of cash flow, and avoid forgotten payments.

-

Cash

Every time cash comes in or goes out, it gets logged. Whether it’s a cash sale, ATM withdrawal, or cash deposit—this record helps you monitor liquidity.

-

Inventory

This tracks what you have in stock, what it costs you, and how much has been sold. It’s crucial for product-based businesses that don’t want to run out—or overbuy.

-

Loans Payable

If your business took out a loan, this record tracks the original loan amount, payment schedule, interest, and how much you still owe.

-

Owner’s Equity

This is what you, as the owner, have invested in the business. It also includes any withdrawals you’ve made for personal use. It’s your stake in the company.

-

Purchases

Every time your business buys something—office supplies, equipment, inventory—it gets recorded here. This helps track your cost of goods sold (COGS) and general business expenses.

-

Payroll Expenses

Wages, salaries, bonuses, and taxes you pay to employees. These records help with tax returns and show where your payroll dollars are going.

-

Retained Earnings

These are your profits that haven’t been paid out as dividends or withdrawals. It’s the income your business holds onto and reinvests.

-

Credit Sales Transaction

This record tracks any sales made on credit—where a customer gets the goods or services now but pays later. It links to your accounts receivable and shows what’s still outstanding.

-

Bank Reconciliation Statements

These records compare your bookkeeping entries with your actual bank statements to catch any discrepancies. They help ensure your books reflect reality—spotting double entries, missed transactions, or banking errors before they turn into bigger problems.

Example Bookkeeping Records: Frequently Asked Questions

What are examples of accounting records?

Examples of accounting records include invoices, receipts, bank statements, payroll reports, general ledger entries, and financial statements like balance sheets and profit and loss reports. These documents track the financial activity of a business and support accurate bookkeeping.

What is bookkeeping with an example?

Bookkeeping is the process of recording a business’s financial transactions. For example, when you purchase office supplies for $100, you log that as an expense in your records. This helps track income statements, expenses, and prepares you for taxes and financial planning.

What is the simplest form of bookkeeping?

The simplest form of bookkeeping is single-entry bookkeeping. Each transaction is recorded once, either as income or expense. It’s best for small businesses or freelancers with straightforward finances and no inventory or complex payroll.

Tired of Figuring Out Bookkeeping on Your Own?

You’ve seen the examples. You know what needs to be tracked. But doing it all yourself? That’s a full-time job you didn’t sign up for.

Let Bookkeeping Match Up take it off your plate. We’ll connect you with a vetted bookkeeping pro who knows the bookkeeping process for your industry, your tools, and exactly how to keep your journal records clean. No searching. No stress. Just effortless bookkeeping—perfectly matched to your business. Let’s chat!